The Importance of Filing Your Tax Return Successfully

Introduction to Tax Returns

Filing a tax return is a critical annual task for individuals and businesses alike. It not only helps the government assess tax liabilities but also ensures that taxpayers comply with legal obligations. Understanding the process and importance of tax returns is crucial, especially as deadlines approach each year.

The Significance of Tax Returns

Tax returns serve multiple purposes. Primarily, they provide a detailed account of income earned and taxes owed or refundable. Completing a tax return correctly can ensure that taxpayers receive any potential refunds to which they are entitled. In the UK, for example, HM Revenue & Customs (HMRC) uses tax returns to determine tax codes and adjust PAYE for individuals.

Current Events in Tax Filing

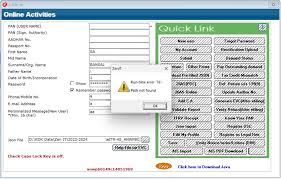

As of 2023, the deadline for submitting Self Assessment tax returns for the tax year ending April 2023 is 31 January 2024. With recent fiscal changes and adjustments in tax brackets, many taxpayers are urged to stay updated with any new policies that could affect their obligations. The increased use of digital platforms has also made the filing process more accessible, yet it has raised concerns regarding online data security and phishing scams, making taxpayers cautious.

Preparing Your Tax Return

Preparation is key to a stress-free tax return process. Taxpayers should gather all relevant documents, including P60s, P45s, and receipts for allowable expenses. It is advisable to keep track of tax reliefs and deductions, especially as many people are unaware of eligible expenses that could reduce their tax liabilities. Consulting with tax professionals or using trustworthy online software can provide valuable guidance.

Conclusion and Future Considerations

Filing your tax return is not just a necessity; it is an opportunity to reflect on your financial year and ensure compliance with regulations. As deadlines approach, taxpayers should remain diligent and informed about their filing status and potential refunds. With the increasing complexity of tax regulations and the advancement of technology in the tax sector, staying proactive and educated about tax returns is more essential than ever. Anticipating changes in tax legislation might also prepare individuals and businesses for a more seamless experience in future tax years.