Current Trends and Future Predictions for Ethereum Price

Introduction

The price of Ethereum (ETH), the second-largest cryptocurrency by market capitalisation, has been a focal point for investors and traders alike. As blockchain technology continues to revolutionise various industries, ETH plays a pivotal role in the decentralised finance (DeFi) and non-fungible token (NFT) spaces, making its price fluctuation not just a matter of finance but also of technological significance.

Current Price Dynamics

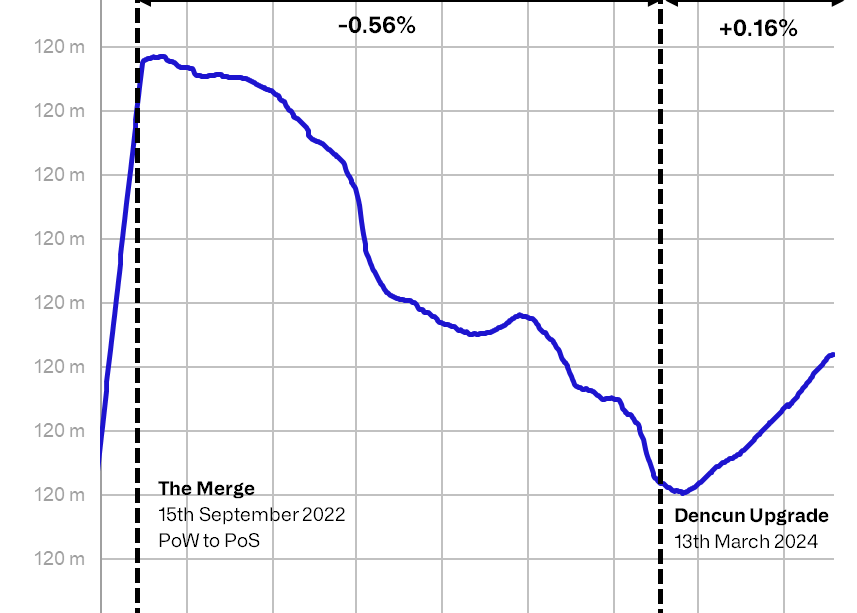

As of October 2023, Ethereum’s price has been experiencing volatility in the face of macroeconomic shifts and regulatory news. According to CoinMarketCap, Ethereum’s price has recently fluctuated between £1,500 and £2,200 over the last month, drawing attention from market analysts and financial experts. The fluctuations are driven by factors such as market sentiment, large institutional investments, and global economic conditions. Moreover, Ethereum’s ongoing transition to a proof-of-stake (PoS) system is anticipated to influence its long-term value.

Market Sentiment and Influencing Factors

Investor sentiment surrounding Ethereum is largely influenced by technological developments and adoption rates. The launch of Ethereum 2.0, aimed at improving the network’s scalability and energy efficiency, has the potential to impact its price positively. Furthermore, the rise of DeFi applications and NFT marketplaces built on the Ethereum blockchain underscores the cryptocurrency’s utility. Recent data shows a significant increase in active wallets and transaction volume, which may suggest a growing demand for Ethereum in various sectors.

Future Outlook

Experts make varied predictions about Ethereum’s future price. While some analysts are optimistic, forecasting a price surge to £3,000 or more by the end of 2023, others urge caution, referencing historical price corrections in the cryptocurrency market. Factors such as regulatory developments, technological advancements, and market adoption will be crucial in determining where Ethereum price heads next. Analysts suggest that investors should remain vigilant and consider both short-term trading opportunities and long-term holding strategies.

Conclusion

The price of Ethereum will likely continue to experience fluctuations influenced by both internal and external market factors. For readers and potential investors, understanding these dynamics is essential for making informed investment decisions. As the cryptocurrency market evolves, tracking developments related to Ethereum and its ecosystem will be crucial for anyone looking to engage with this asset class.