The Rise of Bitcoin: Transforming the Financial Landscape

Introduction

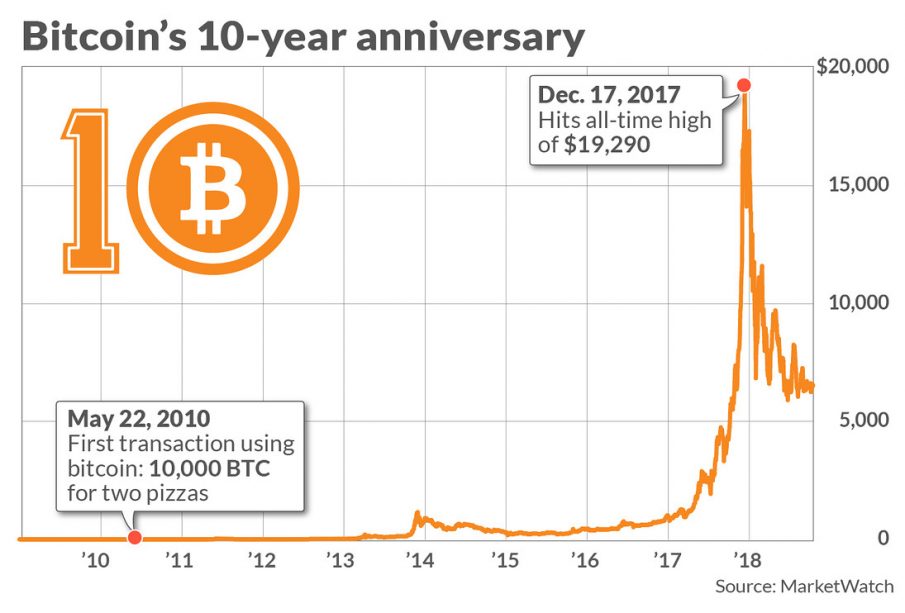

Bitcoin, the world’s first decentralised digital currency, has garnered significant attention since its inception in 2009. As more people and institutions recognise its potential as a valid asset class and a revolutionary form of currency, understanding Bitcoin’s significance has never been more crucial. With its unique technology and increasing adoption worldwide, Bitcoin has transcended being merely a speculative investment option; it is now viewed as a hedge against inflation and a means of financial empowerment in various sectors.

The Current Landscape of Bitcoin

As of October 2023, Bitcoin remains the foremost cryptocurrency in terms of market capitalisation, which has recently fluctuated around $700 billion. Notably, factors such as rising inflation rates and geopolitical uncertainties have further propelled interest in Bitcoin as an alternative store of value.

Prominent companies, including Tesla and MicroStrategy, have made substantial investments in Bitcoin, highlighting a mainstream acceptance that had previously evaded the digital currency. Additionally, institutional investors now play a crucial role in Bitcoin’s market, with firms like BlackRock entering the scene, indicating a shift in how traditional finance perceives digital currencies.

Regulatory Developments

Regulation is another critical aspect affecting Bitcoin’s trajectory. Governments worldwide are debating how to regulate cryptocurrencies, with various approaches emerging. In the United Kingdom, the Financial Conduct Authority (FCA) continues to explore avenues for regulating digital assets to protect consumers while promoting innovation. The ongoing dialogue on regulatory measures underscores the necessity of establishing a balanced framework to enable the continued growth of Bitcoin and the broader crypto market.

The Future of Bitcoin

Looking ahead, optimists argue that Bitcoin could reach new heights, driven by increasing adoption and advancements in blockchain technology. However, challenges such as volatility, regulatory scrutiny, and environmental concerns remain pertinent. The Bitcoin community continues to address these issues, emphasising solutions like the Lightning Network to facilitate faster transactions and reduce energy consumption.

Conclusion

Bitcoin’s evolving narrative is poised to shape the future of finance dramatically. Whether viewed as a speculative asset or a practical currency, its resilience in the face of challenges signals its significance in modern economies. For readers, staying informed about Bitcoin’s developments and fluctuations is essential, as its impact on global finance and personal investment strategies will likely expand in the coming years.