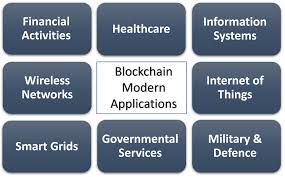

How Blockchain Applications Are Transforming Sectors

Introduction: Why blockchain applications matter

Blockchain applications are increasingly relevant as organisations and governments seek more transparent, tamper-resistant and automated ways to record transactions and data. Originally developed as the underlying technology for cryptocurrencies, distributed ledger technologies (DLTs) now offer tools for contracts, provenance, identity and more. Their potential to reduce intermediaries, improve traceability and enable new economic models makes understanding blockchain applications important for businesses, regulators and consumers.

Main body: Practical uses and current developments

Finance and payments

Finance was the first major area to adopt blockchain. Cryptocurrencies enabled peer-to-peer payments, while decentralised finance (DeFi) uses smart contracts to provide lending, trading and asset management without traditional intermediaries. At the same time, central banks and commercial institutions are exploring or piloting central bank digital currencies (CBDCs) and tokenised assets to improve settlement efficiency and reduce costs.

Supply chains and provenance

Blockchain applications in supply chains aim to improve traceability and reduce fraud by creating immutable records of origin and movement. Manufacturers, retailers and logistics providers use DLT to verify product provenance, certify sustainability claims and speed recalls by identifying affected batches more quickly.

Identity, healthcare and public services

Decentralised identity systems give individuals greater control over personal data and enable secure verification without exposing sensitive information. In healthcare, blockchains can support secure sharing of medical records, consent management and clinical-trial traceability. Public-sector pilots use DLT for land registries and transparent grant management.

Digital rights and tokenisation

Tokenisation turns physical or financial assets into digital tokens that can represent ownership, access rights or revenue streams. Non-fungible tokens (NFTs) have shown applications in digital rights management, while tokenised real-world assets aim to unlock liquidity and fractional ownership.

Challenges and technical trends

Widespread adoption faces hurdles: scalability, interoperability between chains, usability, regulatory clarity and security of smart contracts. Environmental concerns have been reduced for many networks following moves to proof-of-stake consensus, and technical layers such as rollups and sidechains are improving throughput.

Conclusion: Outlook and significance for readers

Blockchain applications are maturing from experimental pilots to production systems across multiple sectors. Readers should expect continued growth in tokenisation, enterprise DLT deployments and regulatory engagement, alongside innovations that integrate blockchain with IoT and AI. Careful assessment of security, governance and compliance will remain essential as organisations evaluate whether and how to adopt these technologies.