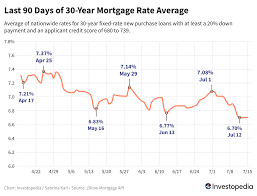

Mortgage rates today: Impact on borrowers and the housing market

Introduction: Why mortgage rates today matter

Mortgage rates today are a central concern for prospective homebuyers, existing homeowners and the wider housing market. Changes in mortgage pricing directly affect monthly repayments, borrowing capacity and decisions about buying, selling or remortgaging. For readers across the UK, understanding the forces that shape mortgage rates is essential for planning household budgets and assessing property market risks.

Main body: What drives mortgage rates today and how borrowers are affected

Key drivers

Mortgage rates are influenced by a combination of macroeconomic and market factors. Central bank policy decisions, particularly the Bank of England base rate, shape the cost of short-term funds and signal monetary policy direction. Inflation expectations and the outlook for economic growth affect long-term interest rates and government bond yields, which lenders use as benchmarks. Lender-specific factors — such as funding costs, competition, and risk appetite — also determine the margins added to benchmark rates.

Types of mortgages and borrower impact

Borrowers typically choose between fixed-rate and variable-rate products. Fixed-rate deals provide certainty over a defined period and protect against rate rises, while variable or tracker mortgages move with benchmark rates, offering potential savings if rates fall but exposing borrowers to increases. Deal lengths, early repayment charges and options for overpayments are important considerations when assessing the total cost and flexibility of a mortgage.

Market behaviour and decisions

When mortgage rates move, lenders may alter product availability, tighten affordability assessments or change loan-to-value thresholds. Such adjustments influence the choices available to first-time buyers, movers and those remortgaging. For many households, even modest rate changes can materially affect monthly budgets, highlighting the importance of stress-testing repayments under higher-rate scenarios.

Conclusion: What readers should do next

Mortgage rates today remain sensitive to inflation trends, Bank of England guidance and bond market moves. Borrowers should monitor official announcements, shop around for competitive deals and consider the trade-offs between certainty and flexibility. Seeking independent financial advice or speaking with a mortgage broker can help match product features to personal circumstances. Preparing for a range of rate outcomes — for example by building savings buffers or choosing deals with repayment flexibility — will help households manage uncertainty in the housing market.