BP share price: What investors should watch now

Introduction: Why the bp share price matters

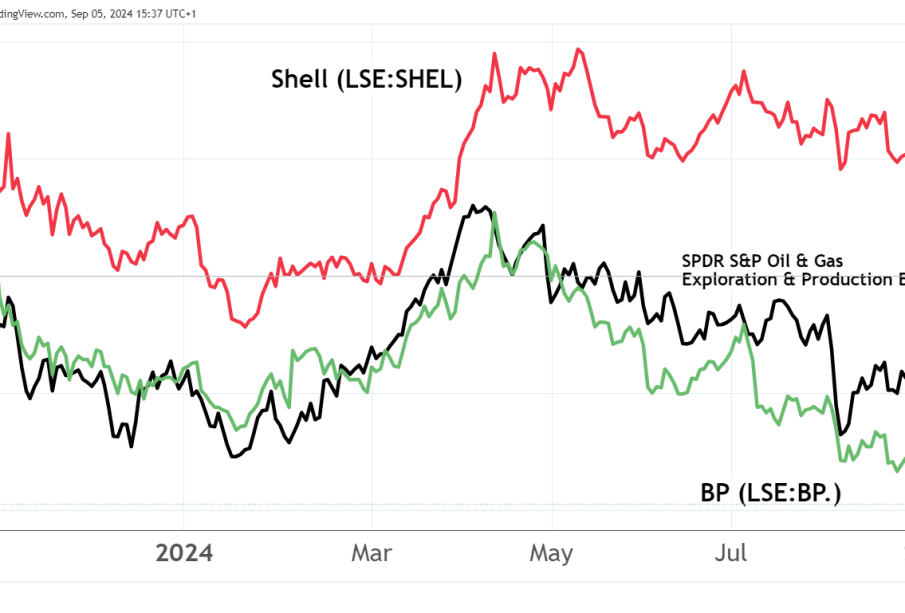

The bp share price is closely monitored by investors, pension funds and consumers because it reflects market sentiment about one of the world’s largest energy companies. Movements in BP’s stock can signal shifts in the energy sector, investor confidence in oil majors’ strategies for dividends and transition to cleaner energy, and broader economic trends. Understanding the drivers behind the bp share price is therefore important for anyone with exposure to energy markets or UK equity benchmarks.

Main drivers influencing the bp share price

Several interlocking factors typically influence the bp share price. Commodity markets are central: changes in global oil and gas prices tend to have an immediate effect on revenues and investor expectations for BP. Geopolitical events, supply disruptions, and decisions by major oil-producing nations can quickly alter commodity prices and, by extension, BP’s stock movements.

Corporate performance also plays a key role. Quarterly results, guidance on capital expenditure, dividend announcements and updates on strategic initiatives—such as investments in low-carbon energy, renewables and carbon management—shape investor views on BP’s long-term prospects. Financial metrics, including cash flow, debt levels and returns to shareholders, are regularly assessed by the market.

Macro factors matter too. Interest rate trends, currency movements and global economic growth expectations affect risk appetite and sector rotation, influencing demand for energy shares. Regulatory developments, climate policy and litigation or regulatory risk in jurisdictions where BP operates can also feed through to the share price.

Events and signals investors often monitor

Investors typically watch company results, management commentary, major project updates and dividend decisions for immediate signals. Market participants also track broader energy indicators—such as inventories, refinery utilisation and demand forecasts—and commentary from industry bodies. Analyst research and changes to index weightings can further amplify movements in the bp share price.

Conclusion: What this means for readers

The bp share price is likely to remain sensitive to commodity swings, corporate news and macroeconomic shifts. For long-term investors, the focus tends to be on BP’s strategy for balancing shareholder returns with the energy transition; for short-term traders, oil and macro headlines are often the primary drivers. Readers should consider their investment horizon and risk tolerance, and seek up-to-date market data and professional advice before making decisions related to BP shares.