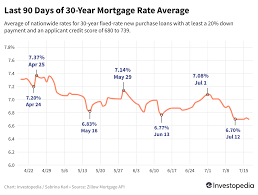

Mortgage Rates Today — What Homebuyers Need to Know

Introduction: Why mortgage rates today matter

Mortgage rates today are a key determinant of housing affordability and mortgage market behaviour. Small moves in rates can materially change monthly payments for borrowers, alter demand for homes and influence refinancing decisions. Given their impact on household budgets and broader economic activity, staying informed about mortgage rates today is important for prospective buyers, existing homeowners and policymakers.

Main developments and factors influencing mortgage rates

Economic indicators and central bank guidance

Mortgage rates generally move in response to trends in inflation, employment and guidance from central banks. When inflation expectations decline or growth slows, long‑term yields tend to soften, which can put downward pressure on mortgage rates. Conversely, stronger than expected economic data or tighter central bank commentary can push rates higher.

Financial markets and investor demand

Movements in government bond yields and investor appetite for mortgage‑backed securities also affect mortgage pricing. Increased demand for safe assets often lifts bond prices and reduces yields, which can feed through into lower mortgage rates. Market volatility, however, can widen spreads and temporarily raise borrowing costs.

Lender behaviour and competition

Individual lenders set mortgage offers based on funding costs, risk appetite and competitive strategy. Promotional deals, changes to fixed‑rate offerings and adjustments to lending criteria mean that mortgage rates today can vary significantly between providers. Borrowers are advised to compare quotes and consider upfront fees, product features and term length.

What borrowers should watch

- Official statements from central banks and major economic releases, which can signal future rate moves;

- Trends in government bond yields and swap rates that underpin mortgage pricing;

- Changes in lender fees or lending criteria that affect the effective cost of borrowing.

Conclusion: Outlook and practical significance

Mortgage rates today reflect a mix of macroeconomic signals, market dynamics and lender decisions. While short‑term fluctuations are normal, borrowers with flexibility might use dips to refinance or lock a rate, whereas buyers should budget for potential changes. Keeping informed and shopping around remain the most practical steps for managing mortgage costs as market conditions evolve.