relx share price: market update and company actions

Introduction — Why relx share price matters

The relx share price is watched by investors interested in information and analytics firms serving professional and business customers worldwide. RELX Plc is a London-based group whose performance reflects demand for data, analytics and risk tools across multiple industries. Movements in the company’s share price and corporate actions such as buybacks or dividends can signal management confidence and affect total returns for shareholders.

Main details and recent developments

Market movement

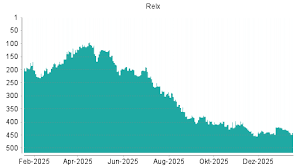

According to recent market reports, RELX shares have decreased by $5.67 since the market last closed. RELX is also listed on US exchanges as an ADR (RELX:XNYS), which market trackers such as Morningstar monitor alongside UK-based listings.

Valuation and trading ranges

CNBC data lists a trailing price-to-earnings ratio (P/E TTM) of 25.21 and reports margins (TTM) at 65.48% and 20.32%. Recent weekly trading extremes include a week high recorded on 27 May 2025 and a week low recorded on 30 January 2026, illustrating some intraperiod volatility.

Corporate actions and shareholder returns

Coverage from market commentators and TipRanks highlights ongoing share buyback activity. Reports note a repurchase of 369,515 shares and further treasury purchases, with commentary that the company has stepped up capital returns via additional buyback tranches. RELX also has a dividend date listed for 08/08/2025.

Financial disclosures

Some headline financial figures were flagged as temporarily unavailable in recent summaries — CNN noted that total revenue, net income and earnings per share were currently listed as temporarily unavailable in its overview. Investors should check company filings and market data providers for restored or updated metrics before making decisions.

Conclusion — What this means for readers

Short-term moves in the relx share price, including the recent $5.67 fall, reflect market trading and investor interpretation of corporate activity. Ongoing buybacks and a scheduled dividend date suggest management attention to shareholder returns, while gaps in publicly summarised financials underline the importance of consulting primary filings and multiple market sources. Investors seeking exposure to RELX should consider valuation metrics, recent trading ranges, buyback progress and confirmed financial statements as part of their decision-making process.