How council tax works: payments, exemptions and surcharges

Introduction: Why council tax matters

Council tax is a key source of local funding in the UK, affecting millions of households and shaping services such as waste collection, schools and social care. Understanding who must pay, how charges are set and the recent changes to rules on empty properties and second homes is important for homeowners, renters and local communities alike.

Main body: What council tax is and recent changes

What council tax is

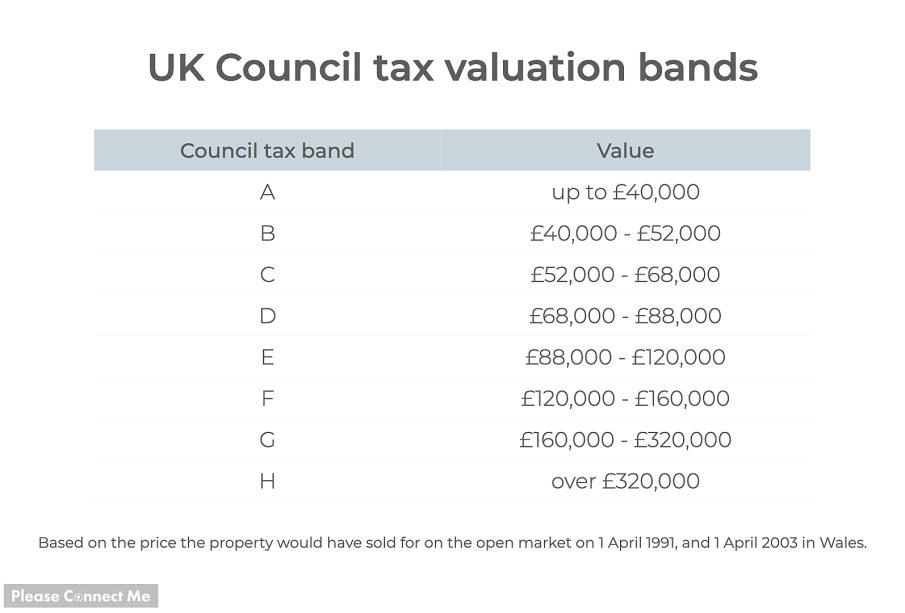

Council tax is a system of local taxation collected by local councils and applied to domestic properties. It is effectively an annual fee levied on households. The cost is set by each local council and the money raised goes towards funding local services. Some properties are exempt from council tax; whether you must pay can depend on the property type, occupancy and other factors.

Who should check their liability

Citizens Advice recommends that people check how council tax works and whether they have to pay. As rules on liability and exemptions can vary by area and by personal circumstances, consulting your local council or Citizens Advice can help clarify whether you are eligible for a discount, exemption or a reduction.

Empty properties and second homes: surcharges and legislation

Beginning in the 2010s, the UK government and the devolved administrations in Scotland and Wales gave billing authorities powers to levy surcharges on properties classed as long‑term empty dwellings or dwellings occupied periodically (commonly known as second homes or holiday homes). In Wales, the Housing (Wales) Act 2014 provided for billing authorities to impose a Council Tax surcharge of up to 100% on properties that have been empty for more than one year or that are used as second homes. The Rating (Property in Common Occupation) and Council Tax (Empty Dwellings) Act 2018 also forms part of the framework allowing authorities to address empty dwelling issues through council tax rules.

Conclusion: What this means for readers

Council tax remains a locally set annual charge that funds essential community services. Homeowners and occupiers should check their council’s rules and consider whether they qualify for exemptions or discounts. Where properties are long‑term empty or used as second homes, councils now have clearer powers to charge higher council tax rates; this may affect owners of such properties and influence local housing availability. For personal cases, contact your local council or Citizens Advice for up‑to‑date guidance.