Apple share price: what investors should watch

Introduction: Why the apple share price matters

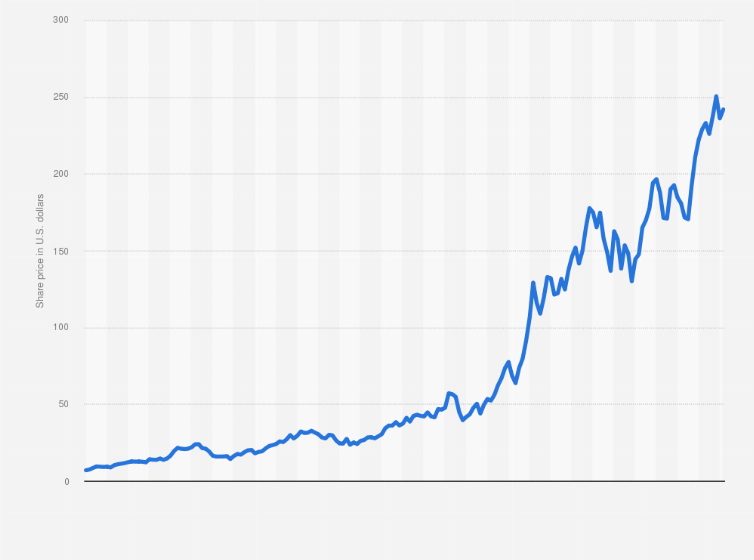

The apple share price is closely watched by individual and institutional investors because it reflects sentiment about one of the world’s largest technology companies and can influence broader market indices. Movements in Apple’s shares affect portfolio performance, sector rotations and investor confidence, making an understanding of the drivers behind its price essential for readers interested in markets or personal finance.

Main factors shaping the apple share price

Earnings, product cycles and revenue mix

Apple’s quarterly results and guidance remain primary short-term drivers. Sales performance across iPhone, services, wearables and other hardware categories signals demand trends. Investors often focus on margins and services growth, since services typically deliver higher recurring revenue and margin stability than hardware alone.

Macro environment and interest rates

Macro conditions influence investor appetite for growth-oriented stocks. Interest-rate policy, inflation expectations and economic growth all feed into valuations. Higher interest rates can compress price-to-earnings multiples for mature technology firms, while a steady or declining rate environment tends to support higher valuations.

Supply chain and production risks

Apple’s global supply chain means the apple share price can react to component shortages, factory disruptions, or geopolitical developments. Manufacturing capacity and logistics constraints may affect product availability, which in turn can influence revenue timing and investor sentiment.

Capital allocation and shareholder returns

Share buybacks and dividend policy are important for many investors. Large-scale repurchases can support the share price by reducing share count, while predictable dividends provide income-oriented investors a reason to hold the stock.

Regulation, competition and innovation

Regulatory scrutiny over app stores, privacy and competition can create headwinds, while advances in artificial intelligence, new product introductions or services expansion can act as catalysts for positive re-rating of the stock.

Conclusion: What readers should take away

Short-term moves in the apple share price are often driven by earnings beats or misses and macro headlines; longer-term performance depends on product innovation, services growth and regulatory outcomes. Investors should monitor quarterly results, guidance, macroeconomic indicators and major policy developments. A balanced approach—considering both fundamentals and valuation—will help readers assess risk and opportunity as conditions evolve.