US inflation holds at 2.7% as debate over ‘defeat’ continues

Introduction: Why us inflation matters

Inflation is a central economic indicator that affects household budgets, interest rates and policy decisions. Recent data showing that us inflation remained unchanged at 2.7% for the 12 months ending December is significant because it sits above the Federal Reserve’s preferred 2% target. Policymakers, markets and consumers monitor these figures closely for signals on borrowing costs, wage pressures and the broader health of the economy.

Main developments and data

Latest official figures

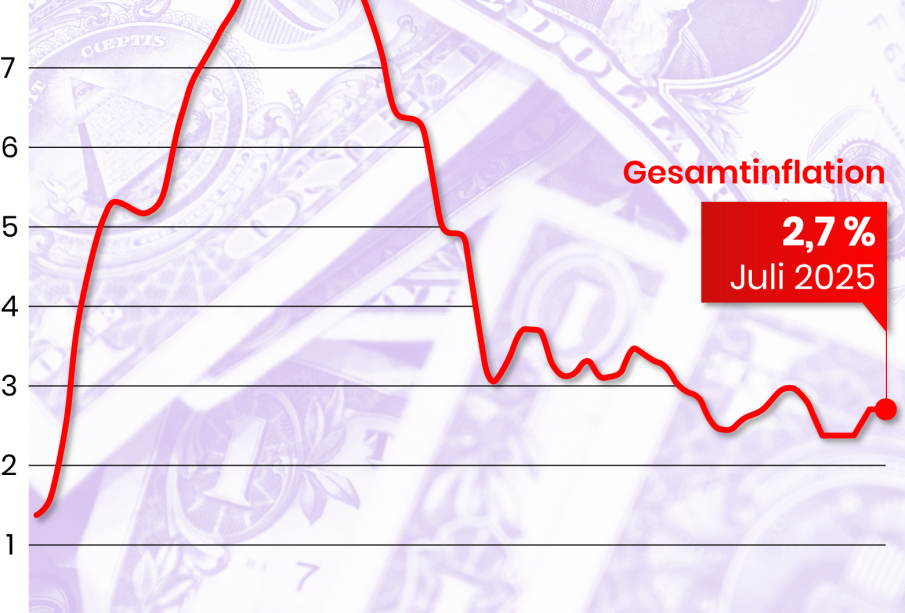

According to U.S. Labor Department data, the annual inflation rate in the United States was 2.7% for the 12 months ending December, the same as previously. Trading Economics confirms the December reading at 2.70% and notes a month-on-month increase of 0.30% for December. Core inflation, which strips out volatile food and energy prices, was reported at 2.60% year-on-year for December.

Historical context and forecasts

Trading Economics adds historical perspective: inflation in the United States has averaged 3.29% from 1914 until 2025, with extremes including a peak of 23.70% in June 1920 and a trough of -15.80% in June 1921. Their global macro models and analyst expectations foresee headline inflation easing slightly to 2.60% by the end of the quarter.

Political and policy debate

The question of whether inflation has been ‘defeated’ entered the political arena after former President Donald Trump claimed at Davos that the US had ‘defeated’ inflation. Media coverage and business analysis have pointed out that, while inflation has cooled from higher levels, the 2.7% rate remains above the Federal Reserve’s target. Federal Reserve President John Williams has also warned that the full effects of tariffs on key importers could be felt towards the end of 2025 and into 2026, adding uncertainty to the near-term outlook.

Conclusion: What this means for readers

In summary, headline us inflation is moderating but not yet at the Fed’s 2% ideal. Short-term models point to a modest decline to around 2.6% by quarter-end, but policy decisions, tariff developments and underlying price pressures will shape the next phase. Consumers and businesses should watch incoming monthly data and official Fed commentary for indications of rate direction and cost pressures in 2026.