Current Trends in Beazley Share Price and Market Impact

Introduction

The Beazley share price has been a focal point for investors and financial analysts alike, particularly as the insurance market experiences fluctuations in both demand and pricing strategies. As a prominent Lloyd’s of London insurer, Beazley’s performance can significantly impact investor sentiment and market trends. Understanding the current status of its share price provides valuable insights into the company’s stability and future potential.

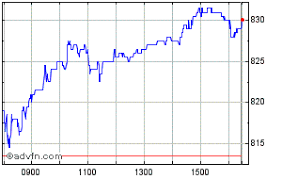

Recent Performance

As of October 2023, Beazley share price has displayed resilience amidst a fluctuating market environment. After experiencing a steep decline earlier in the year due to inflationary pressures and rising claims costs, the stock has rebounded, closing at approximately £6.45. Recent data showed a 15% increase since July, driven by strong Q3 earnings reports which revealed a notable rise in gross written premiums. Analysts attribute this rebound to Beazley’s diversified portfolio and effective risk management strategies.

Factors Influencing Share Price

Several factors are influencing the current Beazley share price. The increased global demand for insurance products, particularly in cyber insurance and property coverage, has allowed Beazley to better position itself in the competitive market. Furthermore, the company has effectively capitalised on higher pricing rates, which have seen an uptick in premium income. However, the ongoing geopolitical tensions and natural disasters remain significant risks, potentially impacting future performance.

Market Reactions

Investors have responded positively to Beazley’s strategic initiatives and solid financial foundation. Analyst ratings have shifted, with many experts recommending the stock as a ‘buy’ reflecting confidence in the resilience and operational strength of the company. The current price-to-earnings ratio stands at 14.5, suggesting room for growth relative to industry peers.

Conclusion

The Beazley share price currently reflects a mixture of positive momentum and inherent market risks. Forecasts indicate that, if the company can maintain its premium growth and manage external risks effectively, there could be further upside potential in coming quarters. Investors should stay vigilant as market conditions evolve, keeping an eye on Beazley’s performance as a key indicator of their overall investment strategy. For those interested in the insurance sector, monitoring Beazley share price trends will remain crucial for informed investment decisions.