Current Trends in Sainsbury’s Share Price

Introduction

The share price of Sainsbury’s, one of the UK’s largest supermarket chains, plays a significant role in reflecting the company’s financial health and market position. Understanding the trends and influencing factors behind its share price is crucial for investors and stakeholders who are keen on the retail sector. In recent months, variations in Sainsbury’s share price have attracted considerable attention, especially in light of broader economic changes and competitive pressures.

Recent Developments

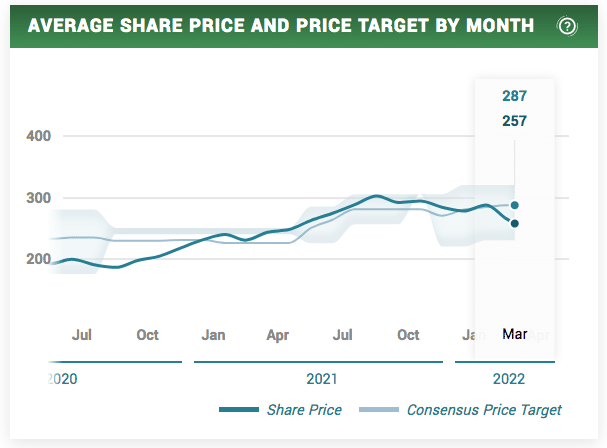

As of late October 2023, Sainsbury’s share price has been experiencing fluctuations, largely due to shifts in consumer spending habits and the ongoing cost-of-living crisis impacting British households. The company’s shares have seen a moderate increase recently, attributed to successful promotional strategies and product expansions that appeal to cost-conscious consumers. According to the latest market reports, Sainsbury’s share price is hovering around £2.50, reflecting both investor confidence and the company’s resilience amid economic challenges.

Factors Influencing Share Price

Several factors influence Sainsbury’s share price, including:

- Economic Conditions: The UK economy’s recovery post-pandemic has been uneven, impacting retail sales and grocery demand.

- Competition: Sainsbury’s faces stiff competition from competitors like Tesco and Aldi, which continues to pressure pricing and market share.

- Operational Adjustments: Sainsbury’s adaptation to digital shopping trends and enhancements in supply chain efficiency are contributing positively to investor sentiment.

- Dividends and Earnings Reports: Recently announced dividends and profit margins from quarterly earnings reports have added positive momentum to the share price.

Conclusion

In conclusion, Sainsbury’s share price remains a barometer of the company’s financial performance amidst a transitioning retail landscape. Investors should remain attentive to ongoing economic trends and competitive dynamics, as Sainsbury’s continues to adapt to changing consumer behaviour. Looking forward, analysts forecast that if the company maintains its strategic initiatives and successfully navigates the current economic challenges, it could see sustained growth in its share price moving into 2024. For stakeholders, keeping an eye on Sainsbury’s share price trends will be vital for informed investment decisions.