Barclays Announces Significant Mortgage Rate Cuts

Introduction

In a move expected to benefit countless borrowers, Barclays Bank has announced a series of mortgage rate cuts that will significantly lower monthly repayments for many homeowners across the United Kingdom. As the housing market remains in a state of flux, these cuts are particularly relevant given the recent fluctuations in interest rates and economic uncertainty. The implications of these changes could be substantial for potential buyers as well as current homeowners looking to remortgage.

Details of the Rate Cuts

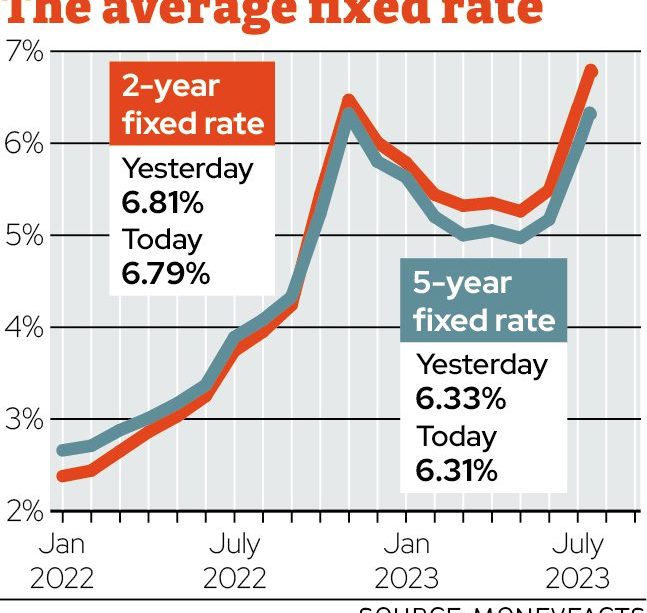

On September 15, 2023, Barclays revealed a reduction in rates across a range of mortgage products, including fixed-rate and tracker options. The most notable cut has seen rates drop by up to 0.25 percentage points, with some products now starting at as low as 2.85% for a two-year fixed mortgage. According to the bank’s representatives, these reductions are part of their commitment to supporting customers amid rising living costs and stabilising economic conditions.

Additionally, Barclays has made adjustments to its lending criteria, aimed at making it easier for first-time buyers to enter the market. By reducing the deposit requirements and offering affordable rates, the bank hopes to encourage homeownership and foster a more vibrant housing market.

Impact on the Housing Market

The announcement has been met with positive feedback from industry experts, many of whom believe that such rate cuts could stimulate demand in the housing market. David Hollingworth, an analyst at London & Country Mortgages, commented, “This is a timely intervention that could spark a renewed interest in property purchases. With rates still relatively low from a historical perspective, we may see an uptick in activity over the coming months.”

However, some economists caution that while lower rates could boost demand, the overall economic climate remains unpredictable, with inflationary pressures still a concern. They advise potential buyers to carefully consider their financial situations before committing to new mortgages.

Conclusion

The recent cuts to Barclays mortgage rates signal a strategic effort to align with current market trends and provide economic relief to borrowers. As potential buyers and current homeowners assess their options, the significance of these rate cuts may lead to a more competitive housing market. It is pivotal for consumers to stay informed and consider both short-term and long-term implications before making financial decisions. With Barclays leading the charge, other banks may follow suit, potentially reshaping the mortgage landscape in the UK.