Understanding Federal Reserve Interest Rates in 2023

Introduction

The Federal Reserve interest rates play a crucial role in shaping the economic landscape of the United States and beyond. As the central bank of the U.S., the Federal Reserve (often referred to as the Fed) adjusts interest rates to control inflation, influence employment levels, and promote a stable financial system. The decisions made by the Fed regarding interest rates not only affect borrowing costs for consumers and businesses but also have far-reaching implications on global markets.

Current Landscape

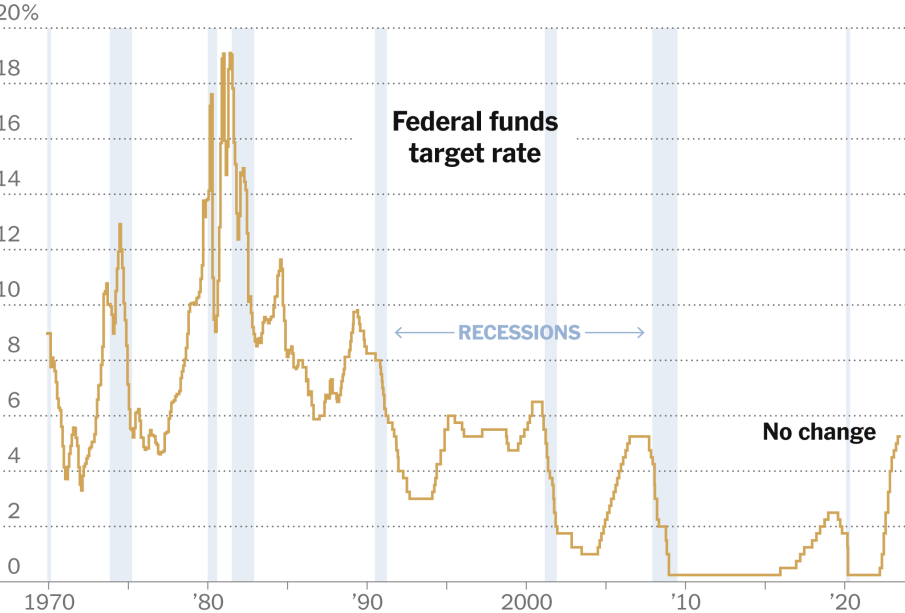

As of October 2023, the Federal Open Market Committee (FOMC) has maintained the federal funds rate in a targeted range of 5.25% to 5.50%. This rate has been influenced by several factors, including ongoing inflation concerns and economic resilience in various sectors. In recent meetings, the Fed has indicated a cautious approach, stating that any changes to the interest rates will depend on incoming economic data and inflation trends.

In a recent announcement, Fed Chair Jerome Powell noted that inflation has shown signs of easing slightly but remains above the target rate of 2%. As the Fed takes stock of economic indicators such as employment rates, consumer spending, and global economic conditions, market analysts speculate on whether the Fed may opt for further rate increases or hold steady in their upcoming meetings.

Impact on the Economy

The implications of the Federal Reserve’s interest rate decisions are multifaceted. Higher interest rates typically lead to increased borrowing costs for consumers, affecting mortgage rates, car loans, and credit card interest rates. As borrowing costs rise, consumer spending may slow down, which in turn can impact economic growth.

Conversely, if the Fed decides to lower rates, it may stimulate spending and investment, providing a boost to the economy. However, such decisions come with the risk of triggering inflation if the economy grows too quickly. Financial experts are closely monitoring these developments, recognising that the Fed’s actions can create ripples across global markets, impacting currencies, commodities, and international trade.

Conclusion

The Federal Reserve interest rates remain a critical focal point for economists, investors, and everyday consumers alike. As the Fed navigates the delicate balance between controlling inflation and fostering economic growth, its decisions stand to affect the financial well-being of millions. In the coming months, stakeholders will be watching closely for any signs of rate adjustments and the potential implications for various sectors of the economy. Continued vigilance from the Fed highlights the importance of sound monetary policy as the U.S. attempts to chart a steady course in uncertain economic waters.