Understanding Stocks and Shares ISA Tax Benefits

Introduction

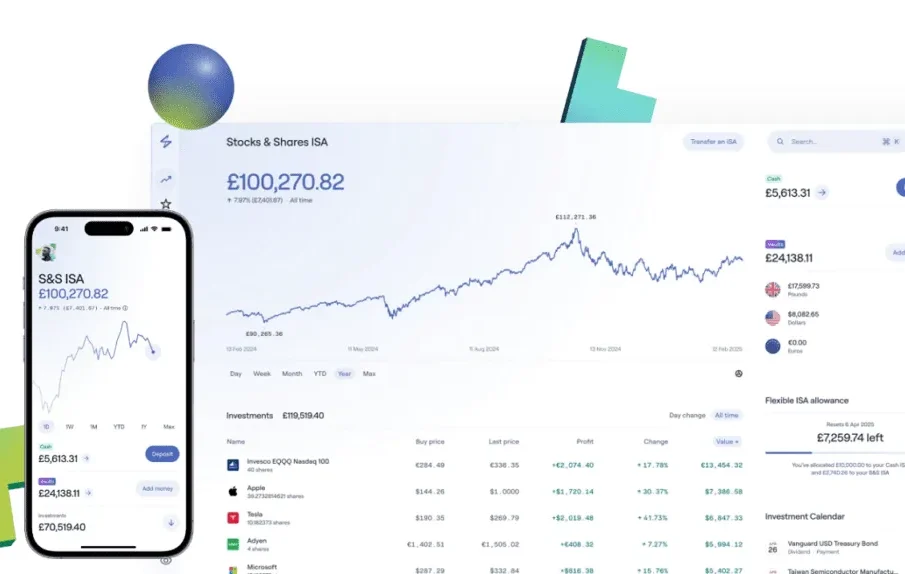

The Stocks and Shares Individual Savings Account (ISA) is an increasingly popular investment option in the UK, providing individuals with a tax-efficient way to save and invest money. With the potential for capital growth and a variety of investment choices, understanding the tax implications of Stocks and Shares ISAs is vital for investors looking to optimise their returns.

What is a Stocks and Shares ISA?

A Stocks and Shares ISA allows UK residents to invest in a range of assets including shares, bonds, and funds without incurring capital gains tax or income tax on any returns made. For the 2023/24 tax year, individuals can invest up to £20,000 in an ISA, which can be split between Cash ISAs and Stocks and Shares ISAs.

Tax Advantages

The primary advantage of a Stocks and Shares ISA is the tax exemption on capital gains. Typically, any profit realised from the sale of investments is subject to capital gains tax, which can be as high as 20%. However, within an ISA, profits made on investments are completely tax-free.

Moreover, any dividends received from shares held in a Stocks and Shares ISA are also free from income tax. This allows investors to reinvest their dividends without the deduction of taxes, further enhancing the growth of their investments.

Realising Gains and Losses

It is crucial to note that while gains made within an ISA are tax-free, losses cannot be offset against other taxable income or gains outside of the ISA framework. Therefore, careful planning and a long-term perspective are essential for ISA investors.

Contribution Limits and Flexibility

The annual contribution limit for ISAs is set by the government and participants need to be aware of it to maximise their investment potential. Additionally, Stocks and Shares ISAs offer flexibility as funds within it can be withdrawn at any time without any tax penalties, making them attractive for savers who may need quick access to their capital.

Conclusion

In conclusion, Stocks and Shares ISAs offer an excellent tax-effective means of investing for UK residents. With no capital gains tax on profits and tax-free dividends, they present significant advantages over regular investment accounts. As the importance of smart personal finance grows, savvy investors are increasingly looking to leverage the benefits of Stocks and Shares ISAs. Moving forward, as savings rates fluctuate and economic uncertainty looms, such investment vehicles could become even more integral to secure long-term financial goals.