Understanding Rachel Reeves’ Back Door Death Tax Proposal

Introduction

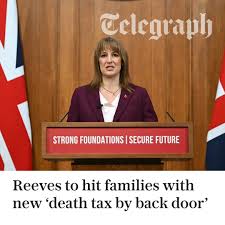

The recent proposal from Labour’s shadow chancellor, Rachel Reeves, concerning a so-called ‘back door death tax’ has ignited significant debate across the UK. With an ageing population, the approach to taxation and inheritance remains a crucial issue for many families in the country. Reeves’ proposal aims to address the public spending deficit while also targeting wealth distribution, making it an essential topic for current economic discussions.

The Proposal Explained

Rachel Reeves has suggested a measure that critics have dubbed the ‘back door death tax,’ which is aimed at altering how inheritance tax is approached in the UK. Currently, inheritance tax is levied at 40% on estates valued over £325,000, which many believe places undue pressure on middle-class families. While her proposals advocate for reforms intended to simplify and possibly lower the rates of inheritance tax, opponents argue that it indirectly raises taxes on the deceased’s estates, effectively operating as a death tax.

Political Reactions

The announcement has not gone unnoticed, with various political figures weighing in. Conservatives have fiercely opposed Reeves’ plans, branding them as a potential burden for grieving families. They argue that increasing the tax burden on inherited wealth could deter individuals from saving and investing, leading to a decrease in overall economic productivity. Conversely, Labour supporters see this as a necessary step to fund essential services without placing additional tax burdens on the working populace.

Public Response

Public opinion appears divided on the matter. Polls suggest that a considerable number of individuals support reevaluating inheritance tax, with many calling for greater fairness in how estates are taxed. However, others remain wary about the implications of more taxes, especially regarding the timing of such discussions amidst rising costs of living and inflation concerns.

Conclusion

The debate surrounding Rachel Reeves’ back door death tax proposal underscores a larger conversation about wealth, inheritance, and the tax system in the UK. As the conversation matures, it will be interesting to observe whether Reeves can effectively persuade her critics and garner public support. Ultimately, the proposal’s impact on families, the economy, and future electoral policies remains to be seen, and voters are urged to consider the implications carefully as the debate unfolds in the coming months.