The Importance of Money Transfer Services in Today’s Economy

Introduction

In an increasingly interconnected world, the ability to transfer money across borders and between accounts has never been more vital. Money transfer services facilitate not only personal remittances but also business transactions, making them essential in the global economy. As people’s purchasing power grows and digital banking evolves, understanding the nuances of money transfer has become increasingly relevant for consumers and businesses alike.

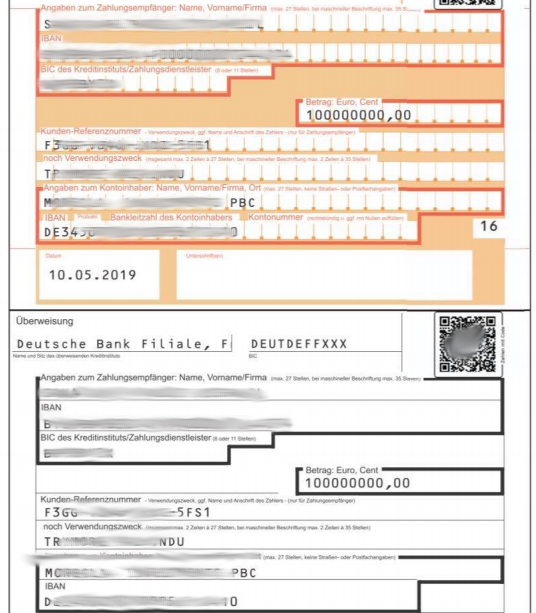

Types of Money Transfer Services

There are several methods through which money can be transferred. Traditional banks offer wire transfers, which are secure but often come with high fees and slower processing times. In contrast, digital solutions such as PayPal, TransferWise, and Revolut provide faster, more cost-effective alternatives, catering particularly to younger demographics who prefer online banking solutions. Additionally, mobile money platforms like M-Pesa have revolutionised the way people in developing countries manage money, allowing them to send and receive funds via their phones.

Recent Trends and Developments

Recent data shows that global remittances reached nearly $700 billion in 2021, demonstrating the growing dependence on these services, especially in low and middle-income countries. The COVID-19 pandemic has further driven the shift towards digital solutions, with many consumers opting for online transfers instead of traditional banking methods due to convenience and safety. As a result, tech-savvy startups are increasingly entering the market offering innovative solutions that are often more user-friendly and less expensive than established players.

The Future of Money Transfers

Looking ahead, the future of money transfer services seems promising as advancements in technology continue to reshape the industry. Blockchain technology offers the potential for instant and secure transactions with lower costs, while central banks are exploring digital currencies that could revolutionise how money is exchanged globally. However, as with any financial service, security and regulatory compliance will remain a top priority for both service providers and consumers. Moreover, the consolidation of services may create a more streamlined experience for users while also fostering competition that drives down costs.

Conclusion

In summary, money transfer services play a crucial role in today’s economy, supporting personal needs and business functions alike. As the market continues to evolve with technology and changing consumer preferences, it is essential for users to stay informed about their options. Understanding these services not only empowers individuals to make smarter financial decisions but also helps businesses tap into a broader customer base in an increasingly digital marketplace.