An Overview of Council Tax in the United Kingdom

Introduction

Council tax remains a significant aspect of local government funding in the United Kingdom, serving as a primary source of revenue for local councils to provide essential services such as waste collection, road maintenance, and education. The importance of understanding council tax is heightened by recent changes and discussions surrounding its fairness, equitable distribution, and impact on residents.

What is Council Tax?

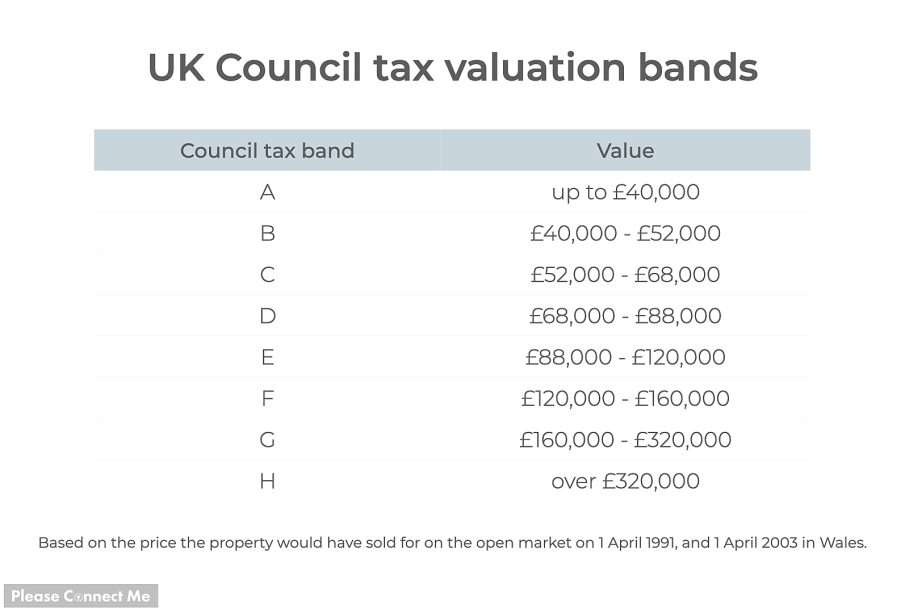

Council tax is a local taxation system collected by local authorities in England, Scotland, and Wales, used to pay for local services. Introduced in 1993, it replaced the community charge or poll tax. The tax is levied on residential properties and is based on the estimated value of the property as of April 1, 1991, categorised into eight bands (A to H). Generally, properties in lower bands face lower tax rates, while those in higher bands face steeper charges.

Current Rates and Exemptions

As of the 2023 fiscal year, council tax rates have seen various increases across councils to meet rising budgetary demands. For instance, some councils have raised their rates by as much as 5% this year, which reflects the ongoing pressures from inflation, increased costs for social services, and a reduction in government funding.

Exemptions and discounts are available for specific groups, including students, seniors, disabled individuals, and certain types of care leavers, which make a significant difference in the financial burden on vulnerable populations. Local councils have also introduced discretionary relief schemes to assist those facing financial hardship.

Impact of Recent Changes

In recent months, council tax has become a topic of considerable debate, especially with the rising cost of living. The government has been urged to reconsider the system to ensure it’s equitable and reflects the economic realities faced by everyday citizens. Many local authorities are advocating for a more progressive structure that takes into account the incomes of residents rather than solely property values.

Conclusion

The future of council tax may see significant modifications as local governments and residents engage in ongoing discussions about fairness and affordability. As inflation continues to rise, there is a growing expectation that reforms will be necessary to make council tax more equitable. For residents, staying informed about how council tax impacts their finances and the potential changes on the horizon is crucial for effective financial planning.