Current Trends in Lloyds Share Price

Understanding the Importance of Lloyds Share Price

The Lloyds share price is an essential indicator for investors interested in the financial sector, particularly in the UK. As one of the largest banks in the UK, Lloyds Banking Group’s stock performance can reflect broader economic trends and influence market dynamics.

Recent Developments Impacting Lloyds Share Price

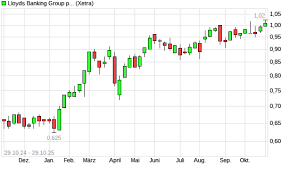

As of October 2023, Lloyds share price has experienced fluctuations influenced by various economic factors such as interest rates, inflation, and changes in consumer behaviour. Recently, analysts have noted that the shares traded around £0.55, a modest recovery from lows observed earlier in the year. This recovery can be attributed to positive economic signals and improved quarterly results from major banks, including Lloyds.

On 5th October 2023, the bank released its third-quarter financial results which showed a significant increase in profit, attributed to lower loan loss provisions and improved net interest income amid rising interest rates. These results positively affected the Lloyds share price, drawing investor interest and confidence.

Market Response and Future Projections

The market responded positively to these results, with analysts adjusting their forecasts for Lloyds share price upward. Many experts predict that as long as economic recovery continues and interest rates stabilize, Lloyds is likely to see a steady increase in its share value. The bank is also engaging in strategic initiatives to enhance customer engagement and reduce operational costs, which could further support share price growth.

Conclusion: What Lloyds Share Price Means for Investors

For current and potential investors, understanding the dynamics of the Lloyds share price is crucial. The bank’s performance in the upcoming quarters will hinge on several external factors, including economic growth rates and competitive pressures within the banking industry. As the financial landscape evolves, Lloyds will remain a focal point for investors looking to navigate the complexities of the UK market.