All You Need to Know About State Pension UK

Introduction to State Pension in the UK

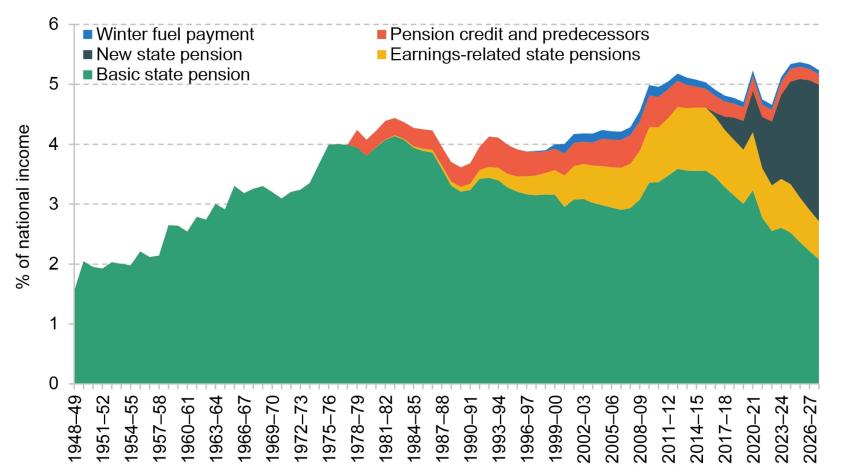

The state pension is a crucial financial support system for retired individuals in the United Kingdom, providing essential income for those who have reached retirement age. Understanding the dynamics of the state pension scheme is vital for current and future pensioners, especially with ongoing changes to the eligibility criteria and payment levels that can significantly impact many lives.

How the State Pension Works

The state pension in the UK is based on National Insurance contributions made throughout an individual’s working life. To qualify for the full state pension, individuals need to have made contributions for at least 35 qualifying years. As of April 2023, the full new state pension amount is £203.85 per week. However, the amount can vary based on individual contribution records and circumstances.

Recent Changes and Developments

In recent years, the government has implemented several changes that affect the state pension scheme. The pension age has been gradually increasing, currently set at 66 for both men and women, with plans to rise to 67 by 2028. These changes are part of a broader initiative to address the aging population and the financial sustainability of the pension system.

Moreover, the introduction of the Triple Lock policy guarantees that pensions increase each year by the highest of inflation, average earnings growth, or 2.5%. However, there have been discussions regarding potential adjustments to this policy amid economic strain, reflecting the government’s broader fiscal strategy.

The Importance of the State Pension

The state pension plays a pivotal role in reducing poverty among the elderly and ensuring a basic standard of living for retirees. Research by the Institute for Fiscal Studies has highlighted that the state pension is a significant source of income for many older adults, with nearly two-thirds of pensioners relying on it for their primary means of support.

Conclusion: What Lies Ahead

Looking ahead, potential reforms to the state pension system and adjustments to the pension age could further alter the landscape for future retirees. As the economic situation evolves, potential changes to the Triple Lock may also impact long-term pension planning for millions. By staying informed about these developments, individuals can better prepare for their retirement and ensure financial stability in their later years.