Understanding the CPI Inflation Rate and Its Impact

Introduction to CPI Inflation Rate

The Consumer Price Index (CPI) inflation rate is a vital indicator used to gauge the economic health of a country. It tracks the average change over time in the prices paid by consumers for a basket of goods and services. Understanding the CPI inflation rate is crucial as it directly impacts purchasing power, economic policy, and the cost of living for households across the UK.

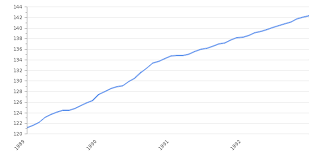

Current Trends and Data

As of October 2023, the UK’s CPI inflation rate stands at 6.7%, according to the Office for National Statistics (ONS). This marks a slight decrease from 7.0% in the previous month, reflecting ongoing fluctuations in energy prices, food costs, and global supply chain disruptions. The Bank of England’s target inflation rate is set at 2%, highlighting a significant gap that has led to increased scrutiny of monetary policy and its effects on everyday life.

The recent decline in inflation for the month indicates that price increases might be slowing. However, essentials such as food and energy continue to see upward pressure, causing continued concern for the average consumer. The food and non-alcoholic beverages sector witnessed a 10.4% hike in prices year-on-year, demonstrating that while the headline rate may fluctuate, underlying cost pressures remain pronounced.

Government and Central Bank Response

In response to the inflationary pressures, the Bank of England has been adjusting interest rates with the aim of stabilising the economy. As of now, the bank’s base rate is at 5.25%, marking a substantial increase from the previous year’s low rates. These adjustments aim to combat high inflation by discouraging borrowing and encouraging savings, although they also risk slowing economic growth and affecting employment rates.

Future Outlook and Implications

The outlook for the CPI inflation rate remains complex. Economists predict that inflation may continue to moderate in the coming months, aided by improvements in global supply chains and potentially stabilising energy prices. However, persistent core inflation, particularly in essential goods, poses a risk that could lead to prolonged financial strain for consumers.

For readers, the CPI inflation rate is not merely a number but a reflection of the economic landscape that influences decisions about spending, saving, and investment. It is essential for consumers to remain informed about these trends to better anticipate changes that could affect their financial health.

Conclusion

The CPI inflation rate serves as a crucial barometer of the economy, informing both policymakers and consumers alike. As the UK navigates a complex economic period marked by inflationary challenges, understanding these metrics will be vital for making informed financial decisions and adapting to the evolving market landscape.