The Stock Market Crash: Causes and Implications

Introduction: The Importance of Understanding Stock Market Crashes

The stock market crash is a significant event that can have far-reaching consequences for investors, businesses and the economy as a whole. The most recent crash, which began in late September 2023, has raised concerns among market analysts and everyday investors alike, highlighting the volatility and unpredictability of stock markets.

Recent Events Leading to the Crash

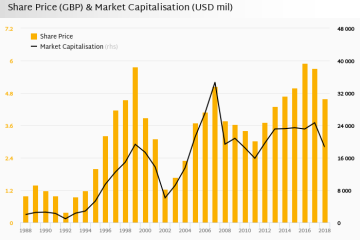

The recent stock market crash was triggered by multiple factors, including rising inflation rates and ongoing geopolitical tensions that have caused uncertainty in global markets. Inflation in the UK peaked at 6.5% in August 2023, leading the Bank of England to consider further interest rate hikes, which negatively affected investor sentiment.

Moreover, the impact of global supply chain disruptions and energy prices skyrocketing due to ongoing conflicts in Eastern Europe added fuel to the fire. As a consequence, major indices such as the FTSE 100 and the S&P 500 saw significant declines, with the FTSE experiencing a drop of nearly 15% within a month.

Impact on Businesses and Investors

This downturn has had a noticeable effect on both businesses and individual investors. Many companies across various sectors, from technology to retail, reported lower earnings forecasts, leading to further sell-offs in the stock market. Investors who had previously enjoyed a bull market were left reeling as portfolios took significant hits, prompting a flight to safer assets such as government bonds and gold.

Conclusion: Looking Ahead

The recent stock market crash serves as a stark reminder of the inherent risks associated with investing. It underscores the importance for individuals and institutions alike to diversify their portfolios and remain vigilant about market trends. As we look ahead, experts predict that the market could take several months to stabilise, depending on various factors, including economic policy adjustments and the resolution of geopolitical tensions. Investors are advised to remain cautious, stay informed and consider expert financial advice as they navigate this turbulent period.