What You Need to Know About Pension Credit

Introduction

Pension Credit is a vital financial support scheme in the United Kingdom designed to assist older individuals with limited income. As of October 2023, the increasing cost of living has placed significant pressure on retired individuals, making the understanding and uptake of Pension Credit more crucial than ever. This benefit provides a safety net, ensuring that those aged over 66 have a minimum standard of living as they age.

What is Pension Credit?

Pension Credit is a means-tested benefit aimed at providing financial relief to seniors with a low income. It comprises two components: Guarantee Credit, which tops up the weekly income to a minimum level, and Savings Credit, which rewards individuals who have saved for retirement. As of April 2023, the minimum amount for Guarantee Credit stands at £201.05 per week for single individuals and £306.85 for couples.

Eligibility Criteria

To qualify for Pension Credit, individuals must be at least 66 years old. Additionally, applicants must have an income below a specific threshold, which includes their pension, savings, and other income sources. Importantly, the criteria are designed to be inclusive, allowing many to benefit. Individuals who own their home, for instance, are still eligible, and those who live in certain types of care facilities may also qualify.

Recent Developments

Recent governmental reforms have aimed to simplify the application process for Pension Credit. The Department for Work and Pensions (DWP) has launched campaigns to raise awareness of this benefit among eligible retirees. These initiatives are particularly crucial as research indicates that nearly one-third of those entitled to Pension Credit do not claim it, potentially leading to financial hardship for many seniors.

The Impact of Pension Credit

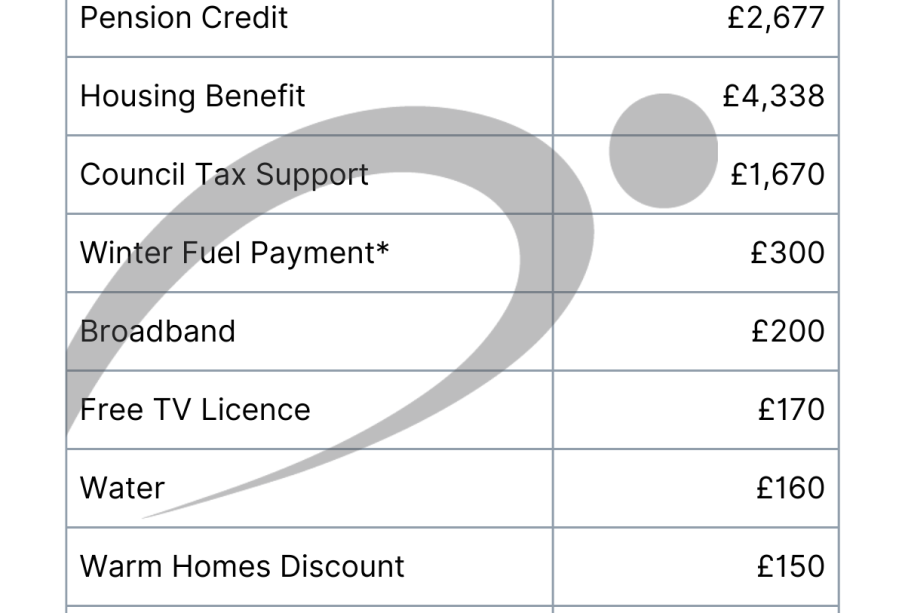

Pension Credit plays a significant role in enhancing the quality of life for many retirees. It not only provides vital financial support but also opens doors to additional benefits, such as housing support and free television licenses for individuals over 75. By alleviating financial strain, it allows retirees to enjoy their later years with a greater sense of security.

Conclusion

As we move forward in 2023, the importance of Pension Credit cannot be overstated. With rising costs and an ageing population, the need for clear understanding and awareness of this financial aid is paramount. Encouraging discussions around Pension Credit can significantly enhance financial literacy and ensure that seniors receive the support they rightfully deserve. Those who think they may qualify should seek guidance and apply without delay to safeguard their financial future.