Current Trends and Insights on Disney Stock

Introduction to Disney Stock’s Significance

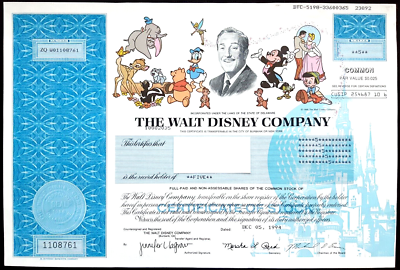

The stock of The Walt Disney Company (NYSE: DIS) has been a focal point for investors and analysts alike, due to its prominent role in the entertainment industry. Tracking the performance of Disney stock is crucial not only for investors but also for stakeholders interested in the company’s future direction, especially amidst a rapidly changing landscape in media consumption and theme park operations.

Recent Performance Analysis

As of October 2023, Disney’s stock has experienced fluctuations driven by various factors. Following a challenging period due to the pandemic, which significantly impacted its theme parks and cruise line businesses, recent reports indicate a rebound as travel restrictions ease and consumer confidence returns. The company’s stock price has shown resilience, recently trading around $92 per share, up from a low of roughly $85 earlier in the summer.

Analysts attribute this recovery to an increase in domestic and international tourism, particularly in Disneyland and Walt Disney World, which are now operating at near full capacity. Additionally, Disney’s strategic investments in its streaming service, Disney+, have begun to yield positive results, with subscriber growth reported to be on an upswing. Disney+ has been pivotal in the company’s push towards becoming a leader in streaming content, competing against rivals like Netflix and Apple TV.

Market Reactions and Predictions

The market’s reaction to the company’s quarterly earnings has largely been optimistic, with projections suggesting that its stock may reach $105 per share by the end of 2023, driven by a solid recovery in theme park revenues and improved content offerings on its streaming platforms. However, some analysts remain cautious, noting potential headwinds such as rising operational costs and increased competition in the streaming arena.

Conclusion: The Future of Disney Stock

In conclusion, Disney stock remains a vital indicator of the health of the broader media and entertainment sector. Investors should keep a close eye on the company’s performance in the coming quarters, particularly as it navigates the ongoing challenges posed by the global economy and changing consumer behaviours. As Disney continues to adapt its business model to leverage both traditional entertainment and digital platforms, stakeholders may find that the future holds significant opportunities for growth.