Understanding the Barclays Share Price Trends

Introduction

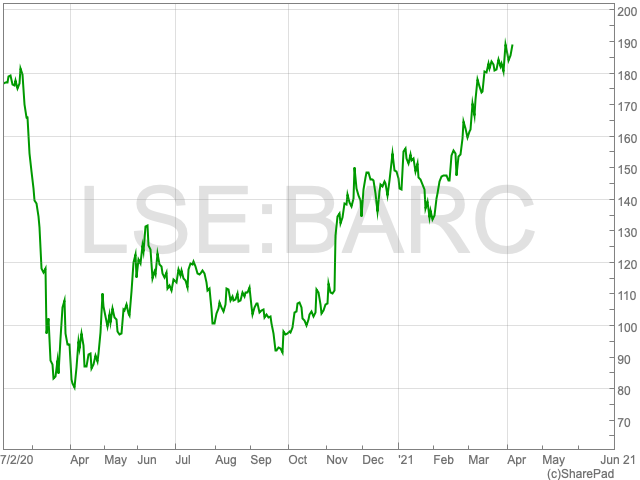

The performance of Barclays share price is a crucial metric for investors and market analysts alike. Reflecting the bank’s financial health, investor confidence, and broader economic conditions, understanding the fluctuations in Barclays’ stock can provide significant insights into the financial services sector. As of late 2023, Barclays has seen notable movements in its share price, stirring significant interest among both retail and institutional investors.

Current Market Overview

In October 2023, Barclays reported a share price hovering around £1.90, reflecting a year-over-year increase of approximately 15%. This rise can be attributed to various factors including improved profit margins, robust lending growth, and a strategic focus on cost reduction. The bank’s commitment to enhancing shareholder value through share buybacks has also positively influenced investor sentiment.

Recent Developments

Recent financial results posted by Barclays indicated a strong performance in their corporate banking segment, which enjoyed increased demand, leading to a significant jump in earnings. The bank’s three-month average share price has demonstrated resilience, despite facing challenges from global market volatility and inflation concerns. Analysts have noted that Barclays has benefitted from the rising interest rates, which have enabled the bank to improve its net interest income significantly.

Future Outlook

Experts predict that Barclays’ share price could continue on an upward trajectory in the coming year, bolstered by anticipated economic recovery in the UK and a potential increase in lending activity. However, uncertainties remain, particularly regarding geopolitical tensions and economic policy shifts which could impose risks. Investors are advised to monitor not only the share price trends but also the macroeconomic indicators that could impact future performance.

Conclusion

In conclusion, the current state of the Barclays share price illustrates the bank’s adaptability and resilience in a dynamic economic landscape. For investors, understanding the key drivers behind the fluctuations of Barclays’ stock is essential for making informed investment decisions. As the financial market evolves, keeping an eye on Barclays’ ongoing performance will remain key to assessing its potential growth and profitability.