Current Trends and Insights on Disney Stock

Introduction

Disney stock, symbolised as DIS, has been a touchstone for investors and fans alike, representing not just a company but a cultural phenomenon. The past year has been tumultuous for Q3 2023, with the stock’s performance significantly influenced by a combination of market volatility, changes in consumer behaviours, and strategic decisions from the company’s leadership. Understanding these factors is crucial for investors looking to make informed decisions in the ever-changing world of stock trading.

Recent Performance

As of late October 2023, Disney stock has seen a notable fluctuation. After a significant decline in early 2023, largely due to concerns about its streaming services and competition, the stock has seen a resurgence. Reports indicate a rise of approximately 15% over the past three months, largely attributed to improvements in box office returns from recent film releases and a successful rebranding strategy for Disney+. The company’s quarterly earnings report released this month exceeded analysts’ expectations, providing positive sentiment in the market.

Strategic Changes

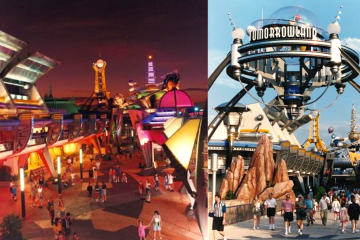

Disney has been undergoing extensive strategic changes that are impacting its stock performance. The appointment of a new CEO with a focus on revitalising Disney’s core businesses, including theme parks and merchandise, has been well-received. Moreover, the recent decision to revamp its streaming model by introducing tiered pricing options appears to be reversing declining subscriber numbers. It remains to be seen how these initiatives will have a long-term effect on the stock, but early indicators suggest a positive trajectory.

Market Outlook

Analysts maintain a cautiously optimistic outlook for Disney stock in the upcoming quarters. The emphasis on returning to theatrical releases that have historically driven substantial revenue, coupled with a new focus on improving profitability in the streaming sector, suggests a strategy aimed at stabilising and potentially enhancing stock performance. Furthermore, the holiday season traditionally buoyed Disney’s revenue streams, thus adding another layer of optimism.

Conclusion

In conclusion, Disney stock remains a significant player in the market despite facing challenges over the last couple of years. With strategic changes underway, a focus on profit and re-engagement with audiences through various means, investors are hopeful. While the stock has shown signs of recovery, potential investors are advised to continue monitoring key performance indicators and industry trends to make well-informed decisions moving forward. The question remains if Disney can maintain this upward trajectory in an ever-evolving entertainment landscape.