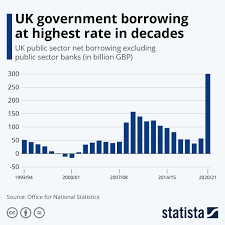

Current Trends in Government Borrowing in the UK

Introduction

Government borrowing is a crucial economic measure that indicates how much the state is relying on loans to cover its expenses. In the context of rising inflation and post-pandemic recovery, understanding government borrowing is more relevant than ever. As the UK grapples with economic challenges, the government’s approach to borrowing may have significant implications for public finances and future fiscal policies.

Current Economic Climate

As of October 2023, the UK government’s borrowing has surged, primarily driven by increased spending due to energy support measures and inflationary pressures. The Office for National Statistics (ONS) reported that net public sector borrowing reached £22.4 billion in September, surpassing economists’ forecasts. Year-on-year, this represents a notable increase attributed to significant outgoings related to energy price guarantees to protect households and businesses from skyrocketing energy costs.

Impact of Economic Policies

UK Chancellor Jeremy Hunt has been under scrutiny for the government’s fiscal strategies, particularly regarding how borrowing relates to long-term economic growth. Higher borrowing levels can mean increased public investment in essential services, but they also raise concerns about sustainability and future tax burdens. The government’s recent decision to maintain these support measures signals its commitment to shielding the economy, albeit at the cost of rising debt levels.

Public Reaction and Future Outlook

The public has expressed mixed feelings towards the government’s borrowing policies. Some advocate for continued support amid rising living costs, while others warn against the risks of escalating national debt. Economists warn that if borrowing continues at current rates without corresponding revenue increases, it may lead to higher interest rates and hinder economic growth in the long run.

Conclusion

The trajectory of government borrowing in the UK remains a complex issue with far-reaching consequences. As we approach the fiscal year-end, the government’s borrowing strategies will be crucial in determining the overall health of the UK economy. Close monitoring of these trends and their implications for public services and taxes will be essential for both policymakers and citizens alike. With economic indicators suggesting potential shifts, it will be vital for the government to balance borrowing with fiscal responsibility to ensure a stable financial future.