Current Situation of Intel Stock: Trends and Insights

Introduction

The performance of Intel Corporation’s stock is of significant interest to investors and analysts alike, especially as the technology sector continues to evolve. As a leader in the semiconductor industry, understanding Intel’s stock movements can provide insights into broader market trends as well as the company’s operational strategies.

Recent Performance and Developments

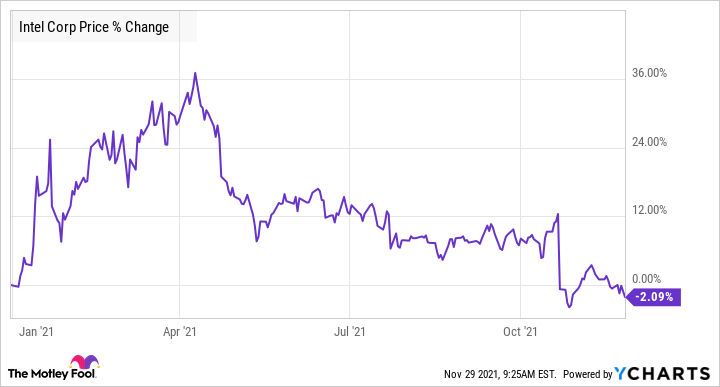

As of October 2023, Intel stock has experienced fluctuations, reflecting both internal challenges and external market conditions. Year-to-date, Intel shares have seen a decline of approximately 12%, with recent dips attributed to supply chain issues and increased competition from rivals such as AMD and NVIDIA. Analysts have noted that Intel’s attempts to regain market share in the data centre space have been coupled with substantial investments in restructuring and production enhancements.

Moreover, the growing demand for AI technology has prompted Intel to pivot towards producing chips tailored for AI workloads. This shift was highlighted at the recent Intel Innovation event where executives outlined plans for new product lines. Investors are watching closely for how these strategies will affect future earnings.

Market Reactions and Analyst Opinions

Market reactions to Intel’s recent earnings reports have been mixed. The Q3 results showed a revenue shortfall compared to expectations, causing a short-term drop in stock price. However, some analysts remain optimistic, pointing to a potential recovery as investments in new technology and production capabilities begin to take shape.

Major investment firms have issued varied ratings, with some upgrading their outlooks based on Intel’s long-term potential in emerging tech markets. Notably, Bank of America has set a price target that reflects this optimistic outlook, suggesting that Intel’s stock may see a rebound as new products hit the shelves and production stabilises.

Conclusion

The future of Intel stock remains uncertain, characterised by both potential challenges and opportunities. For investors, this data indicates the need for a cautious approach, with close monitoring of earnings reports and market trends in the semiconductor landscape. While the current consensus is mixed, signs of recovery in the AI sector could facilitate a significant turnaround for Intel in 2024. Stakeholders should keep abreast of Intel’s strategies and market dynamics, as they are crucial in determining the stock’s trajectory moving forward.