Understanding Fed Rate Cuts and Their Economic Impact

Introduction

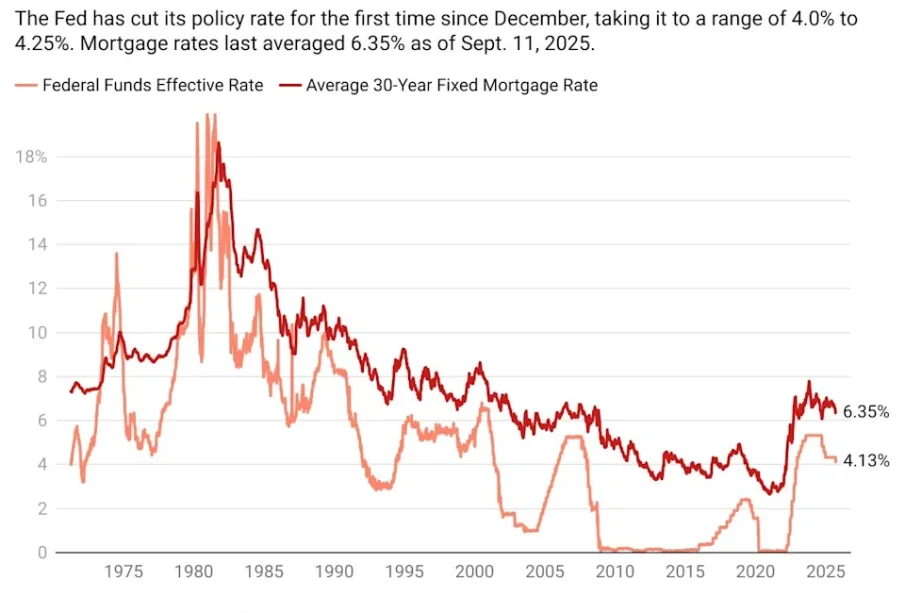

Recent discussions surrounding the Federal Reserve’s potential rate cuts have significant implications for the economy, affecting everything from consumer borrowing costs to inflation rates. As inflation pressures ease in the United States, the Fed is contemplating adjustments to interest rates. Understanding these cuts is crucial for consumers, businesses, and investors alike.

The Current Economic Landscape

As of late 2023, U.S. inflation rates have shown signs of stabilising, prompting the Federal Reserve to evaluate its monetary policy. The central bank is grappling with a balance between ensuring that inflation remains in check and supporting economic growth. After a series of aggressive rate hikes over the past year, the potential for rate cuts has emerged as a viable option for the Fed, with key meetings scheduled to assess the economic outlook.

Potential Effects of Rate Cuts

If the Federal Reserve decides to implement rate cuts, several outcomes could arise:

- Lower Borrowing Costs: Consumers may benefit from reduced interest rates on mortgages, credit cards, and personal loans, stimulating spending and investment.

- Boost to Housing Market: Lower rates could invigorate the housing market, making home purchases more affordable and increasing demand in the sector.

- Stock Market Reaction: Rate cuts typically encourage investment in equities, leading to potential stock market rallies as companies can borrow at cheaper rates.

- Inflation Pressures: While rate cuts might stimulate growth, there’s a risk they could reignite inflation if demand increases too quickly.

Potential Risks

However, not all analysts agree that rate cuts are a clear solution. Some warn that premature cuts could undermine efforts to maintain price stability. The Federal Reserve must weigh the potential benefits against the risks associated with an unstable economic environment.

Conclusion

The discussions around Fed rate cuts are particularly relevant for anyone involved in the economy, from homeowners to investors. As the Federal Reserve navigates these decisions, outcomes will ripple through various sectors. For consumers, staying informed and understanding potential changes to interest rates can help in making better financial decisions. Observers and participants in the market should prepare for volatility in anticipation of what the Fed ultimately decides, acknowledging that the balance between growth and inflation remains delicate.