The Rising Tide of Inflation: Trends and Implications for 2023

Introduction: The Significance of Inflation

Inflation has emerged as a pressing concern for economies worldwide in 2023, influencing everything from consumer prices to interest rates. As central banks respond to rising inflation rates, understanding its causes and effects becomes vital for individuals and businesses alike. With persistent inflation impacting household budgets and corporate strategies, keeping abreast of these developments is crucial for navigating the current economic landscape.

The Current State of Inflation

As of September 2023, the UK witnessed an inflation rate of approximately 6.7%, a decline from the peaks experienced in 2022, which exceeded 11%. The Bank of England has implemented a series of interest rate hikes in an effort to curb inflation, with the base rate now standing at 5.25%. Although the inflation rate has decreased since its peak, it remains above the Bank’s 2% target, signalling that price stability is still a significant challenge.

Underlying Causes

Several factors contribute to the persistence of inflation. Disruptions in global supply chains, exacerbated by the lingering effects of the COVID-19 pandemic and geopolitical tensions, have led to scarcity of goods and an increase in production costs. Furthermore, rising energy prices due to the ongoing conflict in Ukraine continue to strain household finances and business operations. Lastly, robust consumer demand, spurred by the post-pandemic recovery, has also put upward pressure on prices.

Impact on Consumers and Businesses

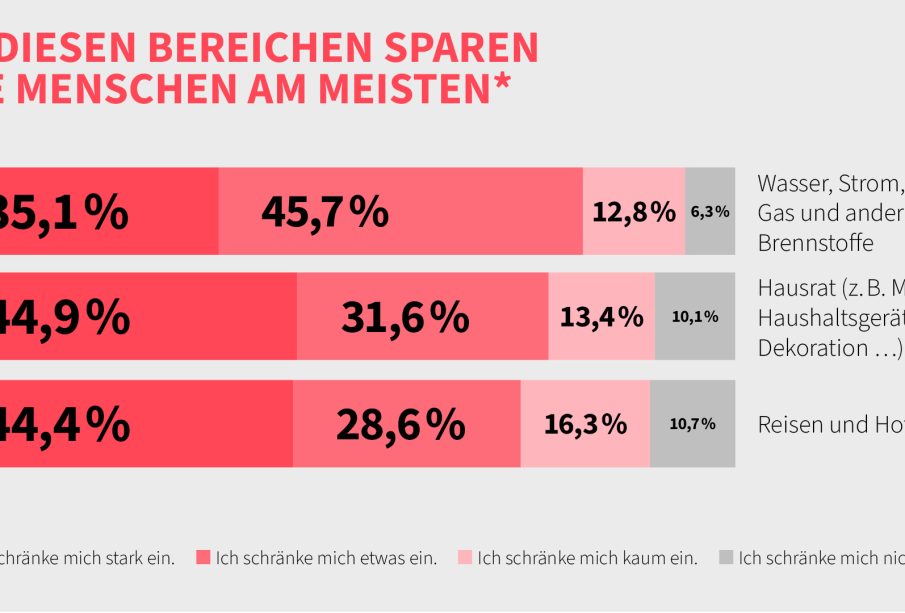

The rising cost of living has significantly affected consumers, with essentials like food and energy seeing the most pronounced price increases. Customers are adjusting their spending habits, seeking discounts, and turning to budget-friendly alternatives as inflation squeezes disposable income. For businesses, the implications are equally profound; companies are facing higher input costs and tighter margins, which may lead them to increase prices, cut jobs, or implement austerity measures.

Conclusion: Looking Ahead

As we approach the end of 2023, forecasts suggest that inflation may continue to gradually decline, with experts predicting it could reach around 4% by the end of the year. However, the road to stability is uneven, and ongoing economic challenges could hinder progress. For consumers and businesses alike, adapting to inflationary pressures will remain essential. Staying informed and agile will be key to effectively navigating the evolving economic landscape as we move forward.