Understanding the Changes to State Pension Age in the UK

Introduction

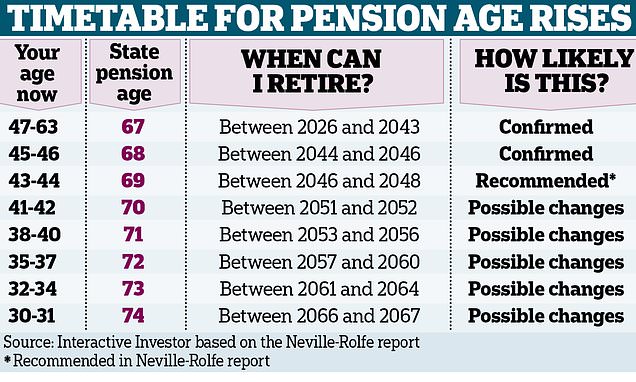

The state pension age (SPA) has been a topic of considerable debate in the UK, impacting millions of individuals as they plan for retirement. Recently, changes have been proposed regarding the age at which citizens are eligible to receive their state pension, which holds significant implications for financial planning and the wellbeing of future retirees.

Current State Pension Age Regulations

As of now, the state pension age is set to rise to 66 for both men and women, with further increases scheduled in the years to come. Under the current legislation, the age is expected to rise to 67 between 2026 and 2028, and potentially to 68 by the late 2030s. These adjustments are part of a broader strategy to ensure the sustainability of the pension system in an aging population.

Recent Developments and Proposals

In October 2023, the UK government announced a review of the state pension age policy, driven by ongoing concerns over fairness and the financial implications of raising the retirement age. Advocacy groups and individuals have voiced concerns that certain demographics, particularly those in manual occupations, face greater health challenges that could impact their ability to work until a higher age. As a result, ministers are being urged to consider a more flexible approach that accounts for various factors, such as life expectancy and health inequalities.

Impact on Individuals

The rise in the state pension age may have far-reaching consequences for individuals. Those who were planning their retirement around the current threshold may now need to adjust their savings strategies. Moreover, the uncertainty surrounding potential further changes could lead individuals to reassess their employment options and retirement timing.

Future Predictions and Conclusion

Looking forward, it remains to be seen how governmental reviews will reshape the state pension age framework. As discussions unfold, there are calls for transparency and fairness in ensuring that the aging population is adequately supported in their later years. As a reader, it’s important to remain informed on these developments as they may significantly influence your retirement plans. Engaging with financial advisors and keeping abreast of policy changes will help individuals navigate this evolving landscape effectively.