Centrica Share Price: Current Trends and Market Insights

Introduction

The Centrica share price has caught the attention of investors and analysts alike as the energy industry undergoes significant changes. As a major supplier of gas and electricity in the UK, the company’s performance is intricately linked to broader market dynamics, regulatory shifts, and geopolitical events. Understanding the movements in Centrica’s share price is crucial for stakeholders looking to make informed investment decisions.

Current Share Price Overview

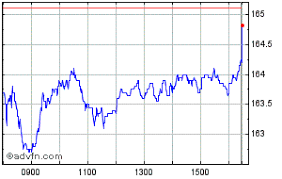

As of October 2023, Centrica’s shares are trading at approximately £1.18, reflecting a modest increase of about 3% over the past month. This upward trend follows the company’s solid performance in the first half of 2023, where it reported a 15% rise in operating profits, attributed largely to a rebound in energy demand and strategic cost management. Analysts predict that the share price may continue to rise, but caution that it remains sensitive to regulatory changes and global energy prices.

Factors Influencing Centrica’s Share Price

The fluctuations in Centrica’s share price are influenced by several factors, including:

- Energy Prices: As a provider of energy, Centrica’s profitability is closely tied to market prices for gas and electricity. Any significant changes in crude oil or natural gas prices can directly impact the company’s revenue.

- Regulatory Environment: Changes in government policy regarding energy regulation and sustainability can also affect Centrica’s operational costs and pricing strategies, influencing investor sentiment.

- Market Competition: The increasing competition from renewable energy sources and alternative suppliers adds pressure on Centrica to innovate and optimize its offerings to retain market share.

Recent Developments

Recently, Centrica has announced its commitment to achieving net-zero emissions by 2050, a move that could enhance its reputation among environmentally conscious investors. As part of this strategy, the company is investing in renewable energy projects and digital transformation to improve efficiency and customer experience.

Conclusion

The Centrica share price is a focal point for many investors as it embodies the challenges and opportunities present in today’s energy market. While the recent trends indicate potential growth, ongoing scrutiny of regulatory policies and market conditions remain key to understanding the future trajectory of Centrica’s shares. Investors should continue to monitor these elements closely to make informed decisions regarding their holdings in this prominent energy supplier.