FTSE 100 Shows Resilience Despite Global Market Pressures and Rising Bond Yields

Current Market Performance

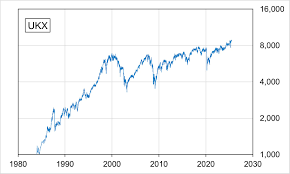

The UK’s main stock market index has recently experienced some volatility, settling at 9208 points on September 5, 2025, with a slight decline of 0.09% from the previous session. However, the index has shown overall strength with a 0.48% increase over the past month and an impressive 12.55% gain compared to the same period last year.

Key Market Drivers

A significant development in the UK financial markets is that the long-term borrowing costs have reached their highest level since 1998, with the 30-year gilt yield rising to 5.680% in early trading. This presents a particular challenge for Chancellor Rachel Reeves as she prepares the autumn budget.

The FTSE 100 has demonstrated remarkable resilience, recently achieving record highs with support coming from multiple sectors including mining, retail, and defensive stocks. This positive momentum has been further bolstered by strong business activity data, which showed the highest levels in a year.

Global Economic Context

Market sentiment is currently being influenced by expectations regarding US interest rates, with the Federal Reserve expected to implement rate cuts following signals from Chair Jerome Powell.

Business Impact

Recent analysis from the Global Payroll Alliance has revealed concerning trends in the UK business landscape, with over 16,313 business insolvencies recorded since recent government changes to Employer National Insurance Contributions and the National Living Wage. This represents a 1.5% increase compared to the previous period, with projections suggesting that by the end of 2025, nearly 24,770 companies could face liquidation, marking the second-worst year for business failures this decade.

Currency Markets

In currency markets, sterling has faced pressure, experiencing a significant 1% decline against the US dollar to 1.3407, marking its most substantial daily drop in almost three months.