The Rise of Premium Bonds: A Popular Savings Option in the UK

Introduction

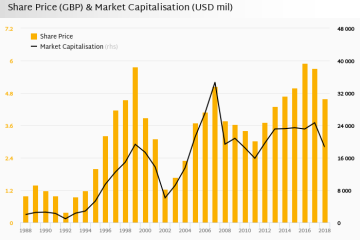

Premium bonds have become an increasingly popular savings option for many individuals in the United Kingdom. Launched in 1956 by National Savings and Investments (NS&I), these bonds offer a unique twist on traditional saving methods by providing individuals the chance to win tax-free prizes instead of earning interest. With current economic concerns and an unpredictable financial landscape, the importance of understanding premium bonds, their benefits, and their associated risks cannot be understated.

What Are Premium Bonds?

Premium bonds are essentially savings products that allow individuals to deposit money while also having the potential to win cash prizes through a monthly lottery. Each £1 premium bond purchased provides a ticket for the draws, and there are no limits on the number of bonds one can buy, with a maximum investment ceiling of £50,000 per individual. As of October 2023, the total number of bondholders has exceeded 23 million, signifying their enduring popularity among UK savers.

Recent Developments

Recent news indicates that the prize fund for premium bonds has seen a significant increase in response to rising interest rates, with the annual prize fund now standing at over £500 million. The odds of winning also improved, now calculated at 24,000 to 1 per £1 bond. This increase comes at a time when many traditional savings accounts are not keeping pace with inflation, making premium bonds an attractive alternative for those looking to preserve and potentially grow their savings.

Advantages and Disadvantages

The main advantage of premium bonds is the potential for winning prizes, with a top prize of £1 million available each month. Additionally, money held in premium bonds is secure, backed by the UK government, and savers can withdraw their funds at any time without penalties. However, the downsides include the fact that no guaranteed returns are provided, and many bondholders may find themselves without any winnings over extended periods. Thus, premium bonds should be viewed more like a lottery than a conventional savings mechanism.

Conclusion

In conclusion, premium bonds offer a unique and secure method to save money while enjoying the thrill of a lottery. With the current financial climate prompting many to explore different savings options, understanding premium bonds and how they work is essential. While they may not suit everyone’s financial strategy, their appeal lies in the exciting potential for reward without any risk to the principal investment. As interest in these savings products continues to grow, individuals should carefully consider their own financial goals and risk tolerance before investing in premium bonds.